“It is clear that the decline of a language must ultimately have political and economic causes . . . It becomes ugly and inaccurate because our thoughts are foolish, but the slovenliness of our language makes it easier for us to have foolish thoughts. The point is that the process is reversible… If one gets rid of these habits one can think more clearly, and to think clearly is a necessary first step”

– George Orwell

George Orwell was renowned for his disapproval of modern English language. He believed that the use of metaphors, abbreviations, crude words and euphemisms constructed limits to rational thought processes and creativity. In his dystopian novel 1984, which I’m sure I’ve referenced before, the totalitarian government develops a language called Newspeak which removes any undesirable concepts and is a tool to control self-expression and individuality. For example, instead of the words “good, better and bad” in Newspeak y ou would use “good, doublegood, and ungood”. By reducing the amount of words in the English language the Party is able carry out both their political and economic agendas more freely.

ou would use “good, doublegood, and ungood”. By reducing the amount of words in the English language the Party is able carry out both their political and economic agendas more freely.

The finance world is ripe with these linguistic techniques. While financiers aren’t necessarily vying for complete domination (directly), this simplicity evolved from the need for fast-paced communication in order for economies to be more efficient and productive.

However, I would make the argument that financial institutions incorporate this colloquial language constantly to bend market sentiment to their will. Whether positive or negative, investors get lost in the tundra of phrases and lingo, unable to capture the true meaning. Shrouded in ambiguity, these establishments are able to manipulate surrounding opinions.

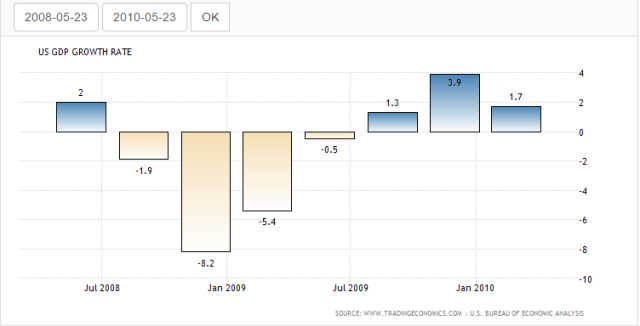

To me one of the most obvious examples surrounds the “the Great Recession”. I included quotations because the economic crisis of 2008 was not a recession. In actuality one could argue that it was a depression. There are many definitions for what constitutes an economic depression. According to Wikipedia (Yes, this is my blog and I’m a college graduate so I can use Wikipedia if I want… sorry Professors) a depression can be a decline in real GDP exceeding 10%, a recession lasting more than 2 years, or four quarters of negative GDP.

Let’s take a look at the charts. Yeah, four quarters of negative growth from July 2008 to July 2009. Now why would anyone in the finance industry prefer to call the crash a recession compared to a depression? The bankers, hedge funds, the Federal Reserve, the US government – they all want to lessen the severity of “the Great Recession” so that they could restore investor and consumer confidence in themselves. Thus they steer clear of anything to do with depression.

One of the main reasons for the mortgage crisis of 2008 was subprime lending which is a great term for confusing the general public. Subprime lending really entailed lenders preying on low income individuals with poor credit. Providing these borrowers with easy credit with little regard for the consequences led to excess defaults and the collapse of multiple financial institutions such as Lehman Brothers. Read between the lines.

When it comes to monetary policy the Federal Reserve is great at using these limited communication techniques to mystify speculators. The best example is the concept of “quantitative easing”. QE is nothing more than a euphemism for creating money out of thin air. By inflating their balance sheet the Fed is able to successfully dilute the currency and artificially stimulate the economy. The term “quantitative easing” is a fantastic word for the Fed to demonstrate that they actually had an easy fix for the economy. This expression provides assurance that the government isn’t actually as incompetent as they seem. While Ben Bernanke takes a lot of credit for his ‘successful’ policy, the US economy is currently having trouble reaching a meager 2% growth rate.

May 18th FOMC Minutes

The Federal Reserve monetary policy continues to dominate the market headlines. Janet Yellen loves to talk about the possibility of raising rates but besides the hike in December 2015 they have been unable to do so. However, before every rate hike meeting there is plenty of speculation and market movement resulting from the ambiguous language used by Yellen and her posse.

During the May 18th FOMC meeting minutes the Federal Reserve sent investors a warning that a June rate hike was not completely off the table. Before the meeting there was little possibility of a rate hike but according to the Wall Street Journal, traders in the futures market put a 34% probability on a move by the June 14-15 meeting, up from just 4% a few days before.

There definitely have been some positive economic data releases in the past couple of weeks that provide some explanation to the changing expectations. U.S. retail and food services sales for April were $453.4 billion, an increase of 1.3 percent from March, the CPI rose by .4% in April signaling inflation might be starting to pick up, and the housing sector continued to show signs of improvement as the number of building permits rose.

This was countered by a weak labor report and economic output expanding at a disappointing 0.5% annual pace.

The main reason that the rate hike expectations increased? Because the Fed continued to incorporate optimistic rhetoric throughout the minutes. Atlanta Fed President Dennis Lockhart said he wouldn’t take a June increase off the table, and Dallas Fed President Robert Kaplan called for rate increases “in the not-too-distant future” and said he might advocate for a move in June or July.

In terms of the low growth Fed officials signaled they weren’t overly worried about the apparent slump, judging it was temporary and “could partly reflect measurement problems and, if so, would likely be following by stronger growth in subsequent quarters,” the minutes said.

Seriously how much more indecisive can the Fed be? Janet Yellen is like a mother telling her children that the cat “ran away” even through their father hit it with his car two hours earlier. This change in language was intended to convey the Committee’s sense that the risks associated with global developments had diminished somewhat. All the Fed is trying to do is make it look like they still have multiple options and flexibility in terms of monetary policy when in reality they have their backs against the wall. I would be shocked if they raise rates in June. As long as the delusion persists that they will raise rates the market will continue to rally after the Fed doesn’t actually raise the rates. It’s a self-perpetuating cycle that will continue to prop up the stock market as investors will continue to pour money into riskier assets in search of yield. Finally, if the Fed actually does raise rates these artificial stock valuations could enter correction territory… All because Yellen is very good at using simple words to convince people of something she most likely (hypocrite) won’t do.

This is fascinating. I’ve always felt that there should be a glossary of terms for financier parlance, but perhaps what we really need is a financial propaganda decoder . . . Great post.

LikeLiked by 1 person

Similar conditions permeate my corporate experience. To succeed I have learned over time that it’s necessary to develop a healthy tolerance for ambiguity. I appreciate your commentary.

LikeLiked by 1 person