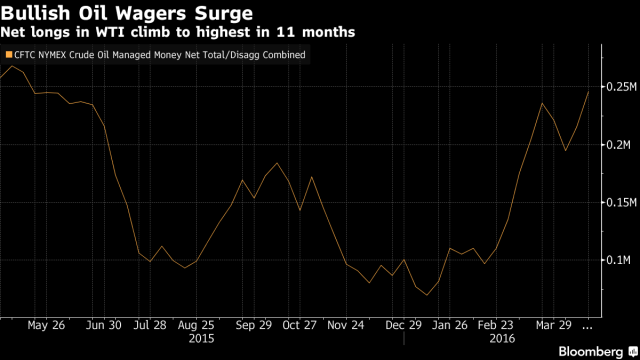

“The plunge and then surge of commodity prices this year shows investors have spent more time watching each other than watching the fundamentals”

Tomorrow is a big day in the global markets with three significant economic releases: the Fed policy meeting, the Bank of Japan policy meeting and a crude oil inventory report. These three reports each will provide some sort of insight into the economy’s direction in the next three months.

Oil will be heavily influenced on the outcome of both the Fed report and the inventories report. The economic instability, strong dollar, and supply gut earlier this year left oil crashing below $27 per barrel. Oil’s decline had wiped out over 10,000 jobs and resulted in more and more energy company bankruptcies. Uncertainty, the sworn enemy of Wall Street, has seemed to be beaten back. Global markets have stabilized in March and April but they are still entering unknown territory with such a drastic difference in monetary policies in countries such as Japan, Europe the United States and China. With oil recovering from its lows of below $27 a barrel to approximately $44.40 on Tuesday the next question is where will it go from here?

On April 17th there was a much anticipated meeting between some of the world’s largest oil producers to see if they could come to an agreement to freeze production output and thus raise prices. The talks were destined to fail. Iran choose not to attend the meeting, intent on raising production to meet pre US sanction supply. Saudi Arabia put the nail in the coffin when they demanded that they would only cap their production levels if Iran did the same.

US Gasoline Demand

Crude indexes were volatile the week before the meeting but surprisingly many investors shrugged off the failure to come to an agreement. Much of this was due to the surge in gasoline demand in the US. US gasoline consumption, averaged over four weeks, rose 3.9 percent from a year earlier to 9.39 million barrels a day through April 15, Energy Information Administration data show. Demand this summer will increase 1.4 percent to a record, the EIA said April 12. Along with this robust demand there are still expectations that production will decline as they did when distillate inventories decreased by 1.1 million barrels in late March.

“Gasoline demand is quite strong and that’s all price driven,” said Thomas Finlon, director of Energy Analytics Group LLC in Wellington, Florida. “Demand for gasoline should provide support for crude.”

Saudi Arabia vs Iran

Russia has been at the forefront of expressing a willingness to negotiate. However, the world’s largest oil producer isn’t stupid. Russia doesn’t anticipate any new initiatives to freeze oil production before an OPEC meeting scheduled for June, according to Energy Minister Alexander Novak. The majority of the inability to negotiate stems from the competitive relationship between Russia’s ally Iran and Saudi Arabia.

Despite Deputy Crown Prince Mohammed bin Salman’s attempt to diversify Saudi Arabia’s economy over the next couple of years, for the time being they will continue to have to be dependent on their black gold. They can continuing taking advantage of their location sites near the surface of the desert and the large size of their fields. Saudi Arabia is in the best position to operate on the global scale as they have the lowest costs of production per barrel alleviating some of the damage from these low prices. They have also established long term contracts with countries such as Japan allowing for a lot more security in demand.

With the lifting of sanctions Iran is looking to ramp its exports back up to two million barrels a day and regain its market share in Europe. They are currently increasing production by 300 to 350 thousand barrels a day and are shooting for 500 thousand in the upcoming months. They are trying to diversify into Asian markets which will be difficult because of the price pressure that Saudi Arabia creates with their long term contracts.

I don’t see any reason for two of the largest producers of oil to curb production.

What about the US?

U.S. oil prices have climbed more than 60% from a 13-year low reached in February. This increase is despite many indicators that global supply is going to be cut. Even though prices have been boosted by the surge in gasoline demand which I mentioned earlier, much of the positive sentiment stems from an improving economic outlook.

US oil producers have been hit hard in the past year. US producers have entered 2016 with estimated capital expenditures cuts of 40%, more than 6,500 drilled but uncompleted wells in inventory, and find themselves operating at or near cash costs.

Analyst of Platts Oil Suzanne Minter does a great report on the ability of the US to respond to an increase in oil prices. She states that, “It is plausible to believe that U.S. spare capacity may be close to rivaling OPEC’s current spare capacity. However, we believe that the prices needed to incentivize the U.S. producer to complete their drilled but uncompleted wells may be much lower than global competitors believe or would like it to be.”

Suzanne basically says that prices are too low right now and that US companies are waiting for the prices to catch up in order to revamp production. She continues to say, “US producers may be in the best position to lead the recovery, given the technical prowess they’ve developed in response to the unique economic environment, by raising production rates and decreasing drill times.”

Saudi Arabia is strong, Iran is stubborn and the US is capable of a quick turnaround. This doesn’t provide much reassurance for production cuts. Crude prices remain vulnerable to a correction because of ample stockpiles. Inventories climbed 2.08 million barrels to 538.6 million in the week ended April 15. This was the highest amount since the 1930s.

Investors are trading on emotion. We’ve been ignoring fundamentals and just riding the waves of volatility. Tomorrow is going to be another day of emotional investing, people are going to be overreacting based on the economic data.

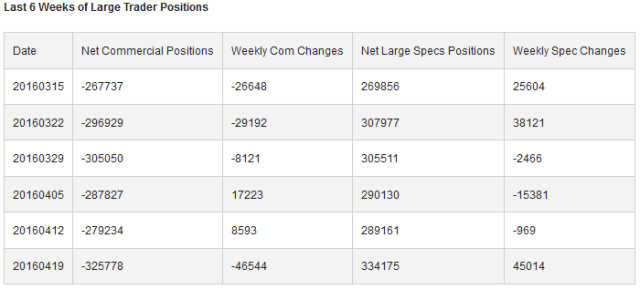

Many money managers are anticipating an increase in the WTI on Wednesday. Non-commercial contracts of crude oil futures, traded by large speculators (i.e. hedge funds) was +334,175 contracts in the data reported for April 19th. This was a change of +45,014 contracts from the previous week’s total of +289,161 reported through April 12th.

There’s little doubt that the Federal Reserve is going to refrain from raising rates tomorrow but Yellen’s report will still provide insight into the current economic outlook. A positive report and no interest rate raises would give me reason to be long on oil… at least for Wednesday. Overall I don’t think there will be a significant change in inventory and the price will move much more on positive news then it would on negative news.

From what I know now oil has no reason to approach $50 per barrel. I would still be concerned about oversupply.

http://graphics.wsj.com/oil-barrel-breakdown/

http://www.platts.com/latest-news/oil/newyork/oil-complex-settles-higher-despite-oversupply-21342126

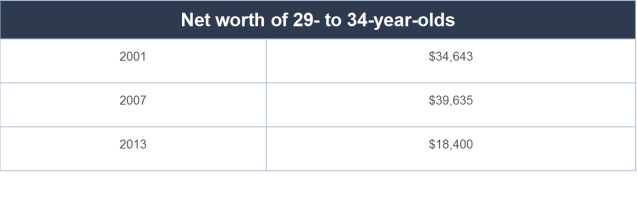

context video that makes you feel smarter. Students are showing just how coddled our generation is. Whether the Halloween incident at Yale or the response to the Trump-chalkers at Emory, these students are doing an excellent job at censoring anyone from saying anything provocative for the fear of being defamed. While I disagree with the majority of these negative stereotypes, some of these events have me worried about the future of America. What is most unsettling to me is not the student protests or the dependence on technology but it is the state of our financial affairs. Millennials have less money to spend, more student loans, and are frequently becoming stuck in low quality jobs. Millennials, born between 1980 and 2000, are shaping our economy as they reach their prime spending and working years. But how can they shape our economy positively when they are in such a miserable financial state? Instead of using social media as a platform to complain about being the 99% or to promote Bernie Sanders’s policy of ‘free tuition’ we can take much more tangible steps to be financially secure. The first and perhaps most important step is to set up a Roth IRA.

context video that makes you feel smarter. Students are showing just how coddled our generation is. Whether the Halloween incident at Yale or the response to the Trump-chalkers at Emory, these students are doing an excellent job at censoring anyone from saying anything provocative for the fear of being defamed. While I disagree with the majority of these negative stereotypes, some of these events have me worried about the future of America. What is most unsettling to me is not the student protests or the dependence on technology but it is the state of our financial affairs. Millennials have less money to spend, more student loans, and are frequently becoming stuck in low quality jobs. Millennials, born between 1980 and 2000, are shaping our economy as they reach their prime spending and working years. But how can they shape our economy positively when they are in such a miserable financial state? Instead of using social media as a platform to complain about being the 99% or to promote Bernie Sanders’s policy of ‘free tuition’ we can take much more tangible steps to be financially secure. The first and perhaps most important step is to set up a Roth IRA.

itself. Compounding provides an easy path to becoming a millionaire by the time you retire. I like to think of it as free money. Your investments into your savings account continue to build and build upon each other until you have a large chunk of change in your pocket… tax-free.

itself. Compounding provides an easy path to becoming a millionaire by the time you retire. I like to think of it as free money. Your investments into your savings account continue to build and build upon each other until you have a large chunk of change in your pocket… tax-free.