(This post is two weeks delayed. No Wifi in my new apartment. Too LOFTY of a goal)

The Federal Reserve has become very successful at dominating market headlines in the past couple of weeks while failing to convince anyone that their monetary policy is going to elicit change. Starting with Janet Yellen’s speech at Jackson Hole on August 26th, investors have been lined up hoping that the Fed Chairman or any of the economic data released in the past two weeks would provide insight into the likelihood of a 2016 rate hike. Unsurprisingly, the Fed managed to weave a web of ambiguous rhetoric. Yellen made no promises, said nothing definitive, and she made sure to quell any fears of a low growth economy. Yellen cautiously worded her speech, “While economic growth has not been rapid, it has been sufficient to generate further improvement in the labor market… … Indeed, in light of the continued solid performance of the labor market and our outlook for economic activity and inflation, I believe the case for an increase in the federal funds rate has strengthened in recent months.” Well done Janet. Her performance was impressively neutral (bland as always) ensuring that her words couldn’t be warped to create any real news. The speech briefly sent US stocks down and bond yields up, but the only takeaway was that the Fed believes there to be a lower equilibrium interest rate than in the past.

Within her explanation of the “monetary policy toolkit”, or of the very few tricks they still have up their sleeves, Yellen provided very little detail regarding future changes to the inflation-targeting framework. Remain skeptical, don’t be the fool who falls into the trap created by fools.

Within her explanation of the “monetary policy toolkit”, or of the very few tricks they still have up their sleeves, Yellen provided very little detail regarding future changes to the inflation-targeting framework. Remain skeptical, don’t be the fool who falls into the trap created by fools.

The biggest economic report came last Friday on September 2nd. The reason the total Non Farm Payroll report is so important is because it may be the last shred of proof that the Fed is ‘data-dependent’. Yellen and her posse love citing the unemployment rate and the labor participation rate as reasons for why the economy is rock-solid. Going into Friday I was skeptical that the labor report would produce any noteworthy results. Why? With the presidential election coming up in the near future there is little room for error for each candidate. One of the strongest arguments for another Clinton presidency (besides the obvious one of Trump being a lunatic) is the low unemployment rates under Obama, and how that would continue if another democrat took office. The point is, the Obama administration is currently rigging the non farm payroll reports. They want the reports to be satisfactory enough so that the economy looks strong. At the same time, they can’t be too good or else the Fed would have to raise interest rates which would cause a prick in an inflated bubble right before the election.

Total nonfarm payroll employment increased by 151,000 in August, and the unemployment rate remained at 4.9 percent, according to the U.S. Bureau of Labor Statistics. Both the labor force participation rate, at 62.8 percent, and the employment-population ratio, at 59.7 percent, were unchanged in August. In August, 1.7 million persons were marginally attached to the labor force, about the same as a year earlier. Among the marginally attached, there were 576,000 discouraged workers in August, little different from a year earlier. This jobs report was about as exciting as Rosie O Donald’s sex life à very round numbers with very little movement up or down. So the government did their job and the chances for a September hike dropped significantly. But that doesn’t mean there isn’t some dissent within the Federal Reserve community. Boston Fed President Eric Rosengren said in a speech on Friday September 9th that “gradual interest rate increases might be in order with the U.S. economy at full employment and that low interest rates were increasing the chance of an overheated economy.”

Let’s check out the other numbers that have been released since Jackson Hole. Whether good or bad, there’s a decent chance that the Fed hasn’t even taken a look at these numbers yet.

Consumer Confidence Index – August 30th

The CCI which had decreased slightly in July, increased in August. The Index now stands at 101.1 (1985=100), compared to 96.7 in July. Short-term expectations regarding business and employment conditions, as well as personal income prospects improved, suggesting the possibility of a moderate pick-up in growth in the coming months.

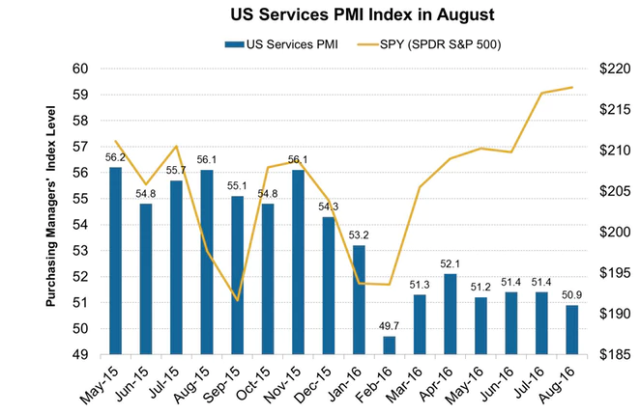

US Markit Services PMI – September 7th

At 51.0 in August, the seasonally adjusted Markit final U.S. Services Business Activity Index dropped from 51.4 in July but remained above the 50.0 (no-change value) for the sixth consecutive month.

Contrasting the Consumer Confidence Report, the weaker-than-expected PMI report sends a downbeat note on economic growth in the third quarter. According to the Markit release the services PMI as well as the manufacturing PMI are pointing to an annualized GDP growth rate of 1%. With low growth and inflationary pressures subdued, the Fed will hesitate to be hawkish in the near future.

ISM Manufacturing – September 6th

The August PMI registered 49.4 percent, a decrease of 3.2 percentage points from the July reading of 52.6 percent. The New Orders Index registered 49.1 percent, a decrease of 7.8 percentage points from the July reading of 56.9 percent. The Production Index registered 49.6 percent, 5.8 percentage points lower than the July reading of 55.4 percent.

These numbers all came in surprisingly weak with the August PMI value of 49.4 being considered in contraction mode.

NMI registered 51.4 percent in August, 4.1 percentage points lower than the July reading of 55.5 percent. This represents continued growth in the non-manufacturing sector at a slower rate. The Non-Manufacturing Business Activity Index decreased substantially to 51.8 percent, 7.5 percentage points lower than the July reading of 59.3 percent, reflecting growth for the 85th consecutive month, at a notably slower rate in August.

The NMI represents growth (or lack-there-of) in the service sector. Two weeks before the FOMC policy meeting this paints a very bleak picture. Will the Fed cite this as the reason for not hiking rates? Will the claim they are data-dependent? Or will they ignore this horrible piece of data in order to paint a prettier picture of the US economy before the election?

Tune in next week to find out what happens next.

ttps://www.conference-board.org/data/consumerconfidence.cfmhttps://

http://www.markiteconomics.com/Survey/PressRelease.mvc/6805ea86f91a414f832731e9f506d942