I want to express my condolences to all of the families currently affected by the terrorist attacks in Belgium. Ok, now I want to point out that I’m an arrogant college student whose condolences mean shit. People offer their grievances in catastrophes such as this, thinking that it shows an awareness or an emotional attachment that transcends self-interest. In reality we just perpetuate that ignorance and selfishness we were trying to avoid in the first place. These petty attempts of compassion, whether changing your profile picture to a French flag or updating a status to “stand in solidarity” with the victims, only continue to belittle the actual tragedy. We internally find some satisfaction in these tragedies as we convince ourselves that we are patriots of freedom fighting to defend the all that is ‘good’ in this world. The media makes it even worse as they find ways to turn the attacks into a political landscape on what presidential candidate would handle these types of situations more effectively. So how do we avoid this paradox of altruism versus egocentricity? We can be more constructive by attempting to engage people directly who have been personally affected by these events, we can continue to promote intellectual discourse to try and better understand the conflict between fundamentalism and capitalism, and finally we can look for ways to support the community around us fighting hate with actions of kindness and compassion.

Well that’s not what I originally planned to write about. I just became more side-tracked then “Squirrel!” that talking dog in the Disney movie UP. Anyway let’s look at some economic data. I’ve been slacking in my analysis of the US economy as my recovery from Spring Break in Cancun took longer than I anticipated.

GDP and Corporate Earnings– March 25th 2016

The third revision for the GDP in Q4 increased to 1.4 up from the advanced estimate of 1.0. The overall state of the economy performed better than anticipated which the Fed might use to as reinforcement for raising interest rates.

Corporate profits had a dismal Q4. The profits from current production decreased $159.6 billion, up from $33.0 billion in Q3. Profits of domestic financial corporations decreased $24.0 billion in Q4 which is much lower than the increase of $1.8 billion in Q3.

http://www.bea.gov/newsreleases/national/gdp/gdpnewsrelease.htm

Durable Goods Report – March 24th 2016

New Orders for manufactured durable goods decreased $6.6 billion by 2.8% in February following a 4.2% increase in January.

Shipments decreased $2.1 billion in in February down .9%.

Inventories of manufactured durable goods in February, down seven of the past eight months decrease $1.1 billion, down .3%.

There continues to be this weakness in durable good, especially in transportation. However, after reading the WSJ people l could barely find an article where any investors show concern.

http://www.census.gov/manufacturing/m3/adv/pdf/durgd.pdf

Markit Flash Services PMI – March 24th 2016

US Services indicated a rebound in March after “A decline driven partly by east coast snow disruptions in February”. The consensus called this rebound “marginal” suggesting a slowdown in growth momentum. The index was 51.0 in March up from 49.7 in February. This average reading for the first 3 months of 2016 (51.3) was the lowest quarterly expansion pace since Q3 2012. This is also the softest expansion of growth since the survey began in October 2009, the beginning of the Recession! The reports detailed uncertainty in the future business environment with subdued business optimism.

One positive was that the rate of hiring stayed around 200,000 growth in March. According to Chief Markit Economist Chris Williamson “Such strong hiring at a time of weak output growth suggests productivity is trending down at the fastest rate seen over the past six years.

https://www.markiteconomics.com/Survey//PressRelease.mvc/673fe609a2ec4e6d8835ef927a94a1bf

Kansas City Fed Manufacturing Survey – March 24th 2016

Factories reported another decline in March although the drop was smaller than in the previous three months. The index was -6 in March up from -12 in February and -9 in January. Manufacturing is still struggling to rebound. The capital expenditure index declined from -10 to -19, declining to its lowest level since December 2009 with a lot of this decline coming from the energy sector.

While capital spending is still constrained some believe that there are new potential business opportunities in the manufacturing industry.

Existing Home Sales in February 2016 – March 24th 2016

Existing Home Sales were down 7.1% in February to 5.08 million. Despite the continued improvement in the labor statistics the sales are meaningfully lower now than one year ago. There was a decline in inventory from last year by 1.1% but was up for the year in 3.3% for the month. The unsold inventory was up 4.0%.

Home prices were up despite the weakness sales activity and have been rising faster than wages. The decreasing affordability and the increased economic uncertainty have been headwinds to consumer spending on houses.

http://www.realtor.org/news-releases/2016/03/existing-home-sales-fizzle-in-february

Like Smalls in the movie Sandlot I’m new to the game. I haven’t been around long enough

to understand the implications of terrible economic data such as the numbers that we have been recently receiving. I’m still figuring out the weight of importance that corporations, the Fed, and the US government put on reports such as the ones above. Maybe these numbers don’t mean that much. Maybe they aren’t nearly as important as the unemployment rate or the number of people entering the workforce. But as a rational investor I would have to consider these numbers to be significant indicators of the poor state of the US economy. I just wonder if the Fed feels the same… and if this will change their minds on raising rates in April.

industries including alcohol, tobacco, gambling, cruise ships, and military. And who knows I might even throw in one of those damn big banks (Don’t let my employer read that). So let’s get right to it and start with the alcohol industry.

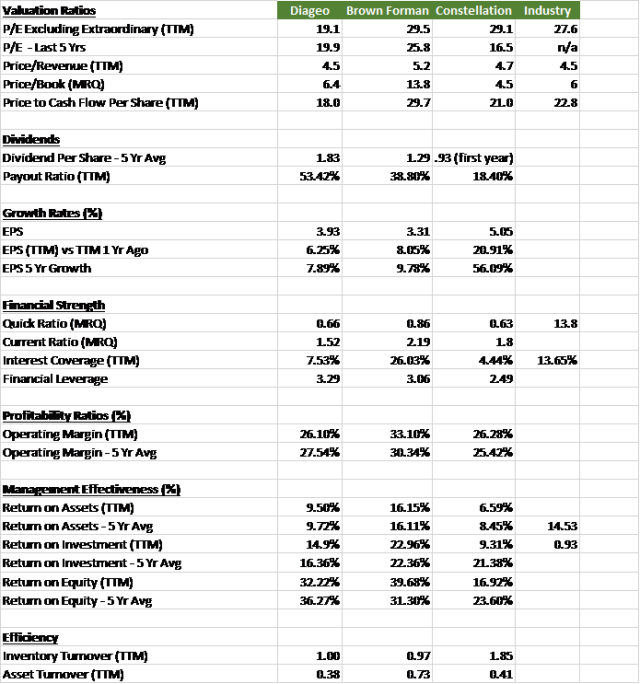

industries including alcohol, tobacco, gambling, cruise ships, and military. And who knows I might even throw in one of those damn big banks (Don’t let my employer read that). So let’s get right to it and start with the alcohol industry. American-owned spirits and wine company with a global reach. Brown-Forman’s first priority is to develop organic growth of their current portfolio while encouraging innovation and considering acquisitions.

American-owned spirits and wine company with a global reach. Brown-Forman’s first priority is to develop organic growth of their current portfolio while encouraging innovation and considering acquisitions.